"I don't follow news or technicals,

I follow the prints."

" I don't follow news or technicals, I follow the prints. "

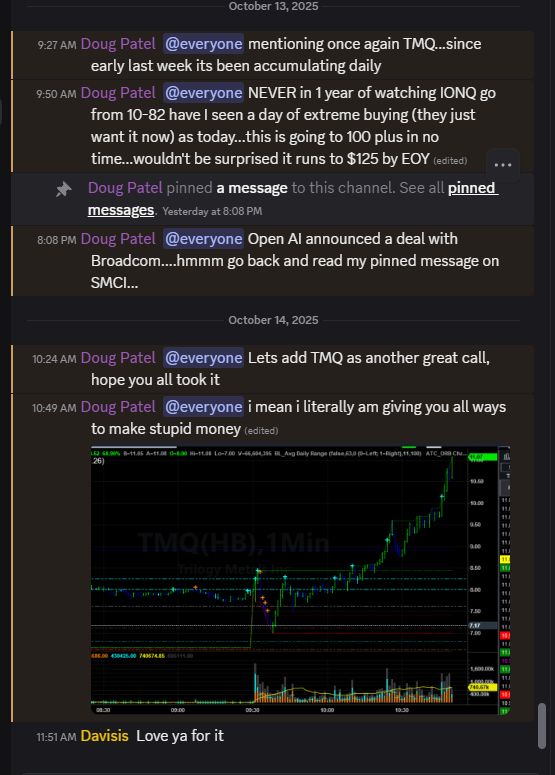

Doug Patel, Master Tape Reader

Founder of Market Making Strategies, a master tape reader with over a decade of experience in equities and options. Trained by one of the industry's most respected traders, he developed a strategy that tracks institutional order flow to anticipate market direction with over 83% accuracy. Today, he teaches traders how to read the tape, follow Smart Money, and execute with precision through the proven framework that has made Market Making Strategies one of the most trusted names in options education.

Over a decade of dedicated tape reading experience in equities and options trading.

Developed a strategy that tracks institutional order flow to anticipate market direction with over 83% accuracy.

Teaches traders how to read the tape, follow Smart Money, and execute with precision through a proven framework.